NPS is mandatory for State Government Employees who have joined services on or after 1st January, 2005 in regular pensionable establishment vide Government in Finance Department Notification No.44451/F, Dated 17.09.2005. NPS has been extended to employees who have joined on contractual basis vide Government in G.A. Department Notification No 32010/GA/ dated 12.11.2013.

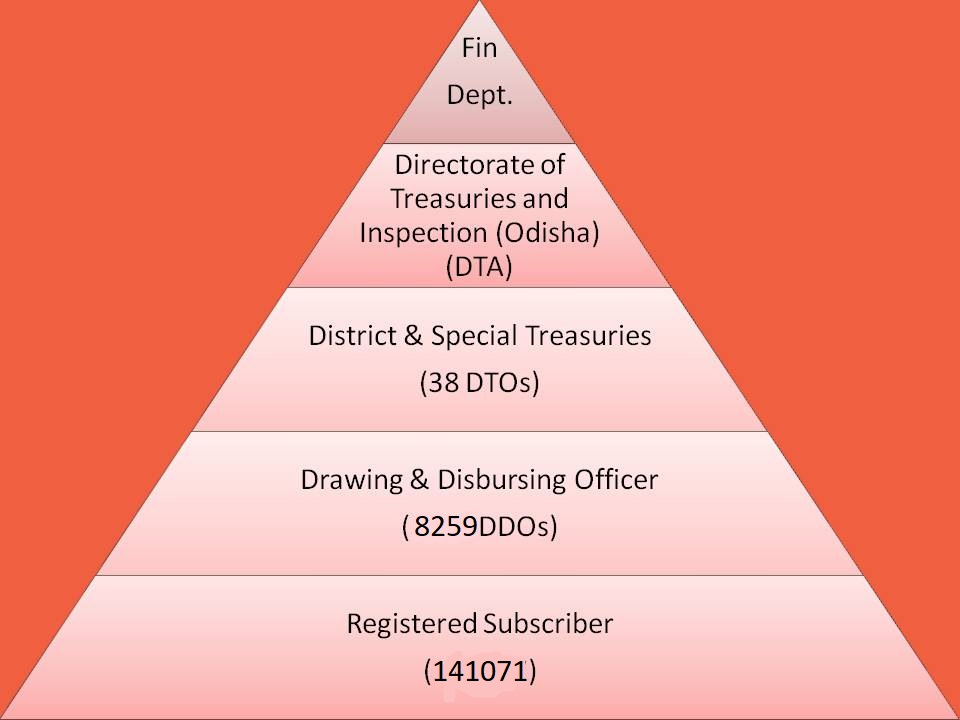

The DT&I(O) has been nominated as the Nodal Agency by Government in Finance Department for implementation of NPS in the state. All District and Special Treasuries are declared as the Nodal Offices.

NPS Cell of Directorate of Treasuries & Inspection, Odisha is responsible for day to day monitoring, contribution uploading and implementation of NPS in the State.

Subscribers monthly contribution details.

Personal Details as registered with NSDL.

Status of new subscriber application.

Have a problem? Connect to us.